Financial Literacy Course In Georgia: Money Smart Financial Literacy Program At Vibe Tribe University

Understanding the language of money and setting financial goals is an essential part of improving your overall financial health. Without proper financial planning we tend to overspend, live beyond our means, and later struggle to save enough to make good investments and retire. To help you reverse this behavior Vibe Tribe University, headquartered in Atlanta, GA offers a comprehensive Financial Literacy Course known as Money Smart. This course will help you explore various concepts of money, including spending, budgeting, setting financial goals, financial planning, managing credit card debit, financing college, introduction to taxes, and more.

Our Money Smart Program is available in four separate curriculum and based on competency level ranging from beginner to advanced levels. Our financial literacy course in Georgia is appropriate to facilitate learning for middle school, high school, and college students, as well as young adults. Interested in learning more? Contact us now and schedule a consultation with one of our knowledgeable enrollment counselors.

Significance Of Financial Literacy In Today's World

Financial literacy is crucial in today’s world because it empowers individuals to make informed and responsible decisions about their finances. In today’s society, it is imperative that teenagers and adults have a concrete understanding and knowledge of financial concepts and skills to navigate their way through the financial arena successfully. Being financially literate helps people understand concepts like budgeting, investing, managing debt, and saving for the future. It can also help students understand how to budget, save, set financial goals & expectations, and achieve financial freedom. With an enhanced understanding of money management and stewardship individuals can navigate turbulent financial times, avoid predatory lending practices, plan for retirement, and achieve their long-term life goals. These benefits play a significant role in promoting financial stability, reducing debt, breaking generational poverty, and building wealth for individuals and their families.

Our Money Smart financial literacy classes in Georgia are here to empower students and participants to make more informed decisions about their finances. The aim of our financial literacy course in Georgia is to offer comprehensive knowledge to participants of all ages and backgrounds to build an understanding of key financial concepts that lead to wise financial decisions.

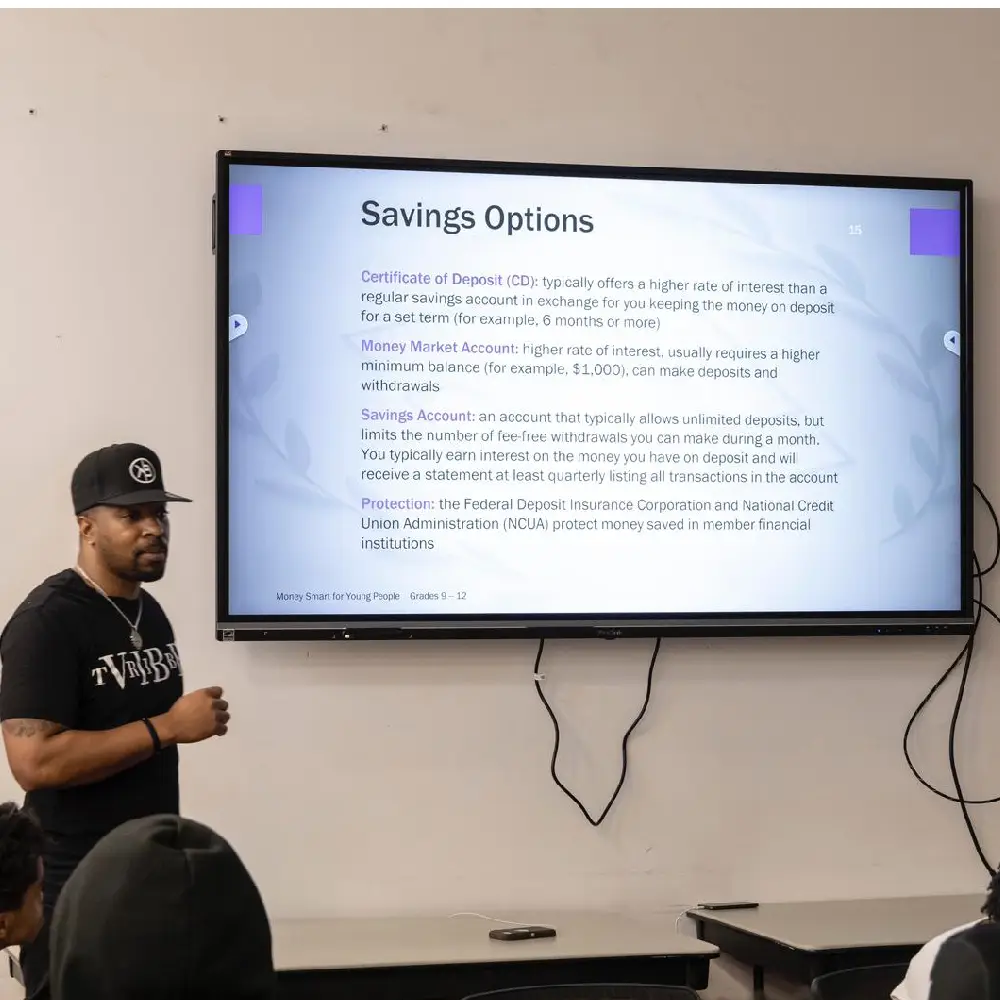

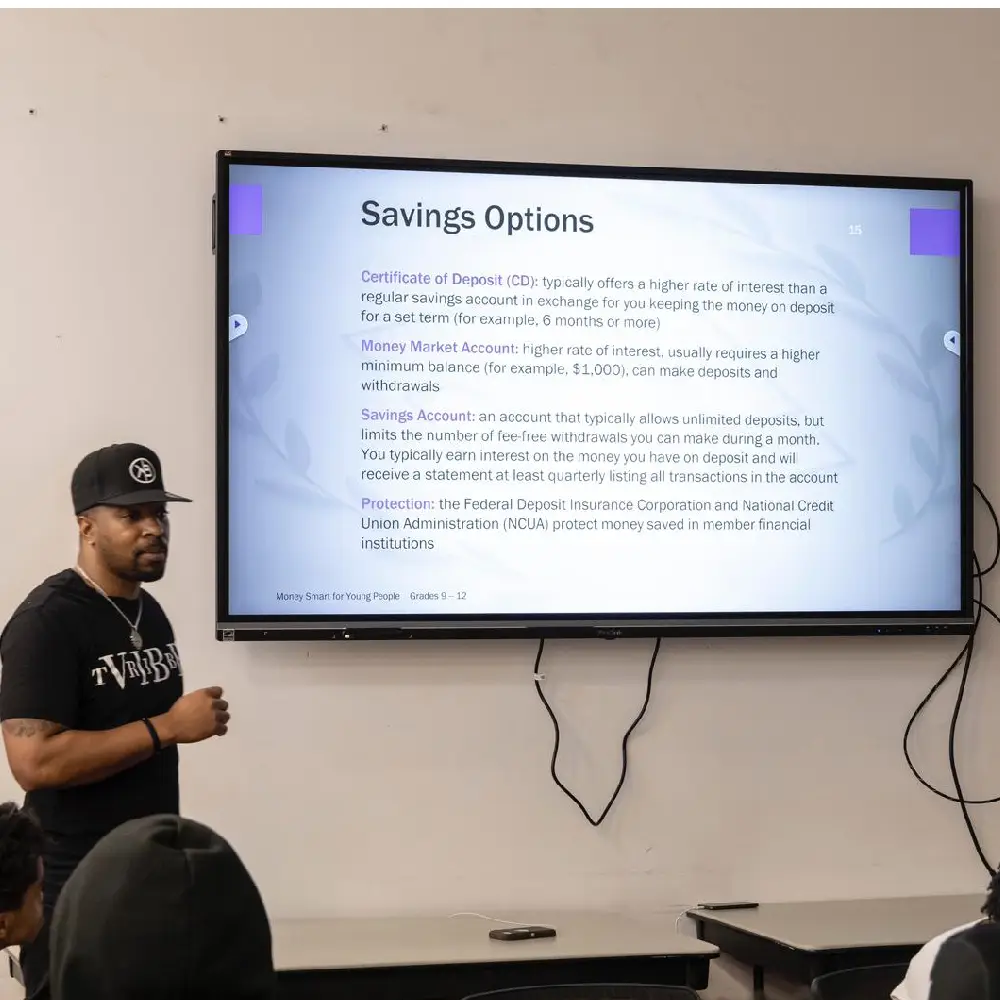

Money Smart Financial Literacy Classes in Georgia: What to Expect

Areas Covered In The Money Smart Program:

- Spending and Budgeting

- Managing Credit & Debt

- Setting Financial Goals

- Financial Planning

- Introduction to Taxes

- Financing College

- Retirement Planning

- Estate Planning

- Home Ownership

- Insurance and More

Why Choose Our Money Smart Program?

Financial Literacy Course in Georgia: How Does VTU Stand Out?

Meet the Lead Instructor

Kenny is a versatile professional serving as a Student Wellness Program Designer, SEL Course Instructor, Mindset Coach, Edutainment Innovator, and Civic Influencer. As the brain behind the acclaimed E.S.A.P Self-Development Framework, he founded VTU in 2019. Kenny’s framework fosters enhanced expectations, structure, accountability, and productivity, yielding internal fulfillment, cohesiveness, breakthroughs, and enterprise-wide transformation.Kenny holds a Bachelor’s in Business Management from Jacksonville State University, AL, and Master’s in Accountancy and Business Administration from the University of Phoenix, AZ and Atlanta, GA. He’s a certified CPA, epitomizing his commitment to holistic development.

Testimonials

What Client says?

Empower Your Teams With Our Tailored Financial Literacy Course

Are you in search of a robust financial literacy course catered to both students and employees? We offer comprehensive courses that delve deep into crucial financial principles, budgeting, and money management, tailored to meet individual, organizational needs. By opting for our specialized program, your team or students gain access to essential financial knowledge, empowering them to make informed decisions. To get started, complete the inquiry form, and our course design specialists will reach out to discuss the program's finer details.